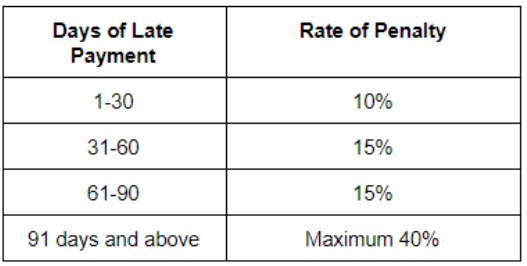

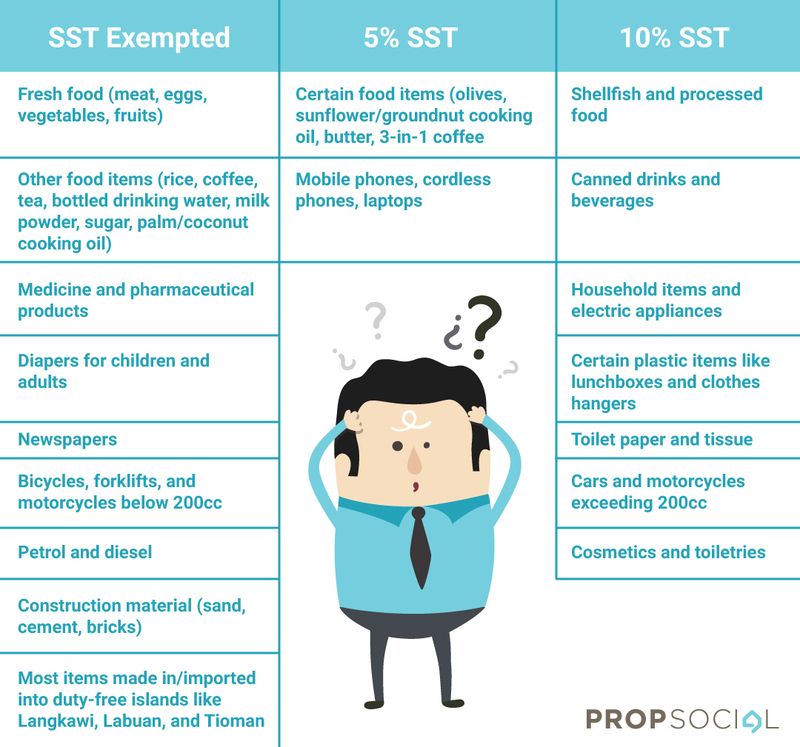

The sales tax charged at 10 is the default sales tax rate in Malaysia. PERSONAL ITEMS Shampoo Toothpaste Shower gel ELECTRICAL APPLIANCES Washing machine Television Radio Electronic devices Smartphones Computer devices Printer MOTOR VEHICLES Passenger motorcars Motorcycles 250cc WATCHESCAMERASSPECTACLES.

Malaysia Sst Sales And Service Tax A Complete Guide

Please click on the title to download the guides.

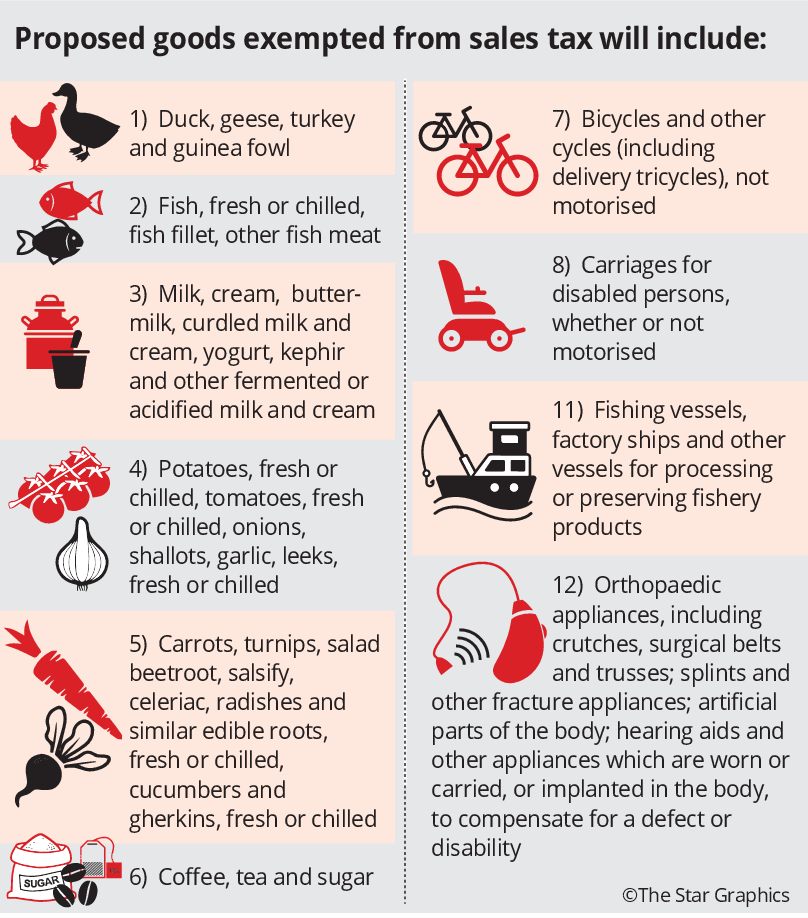

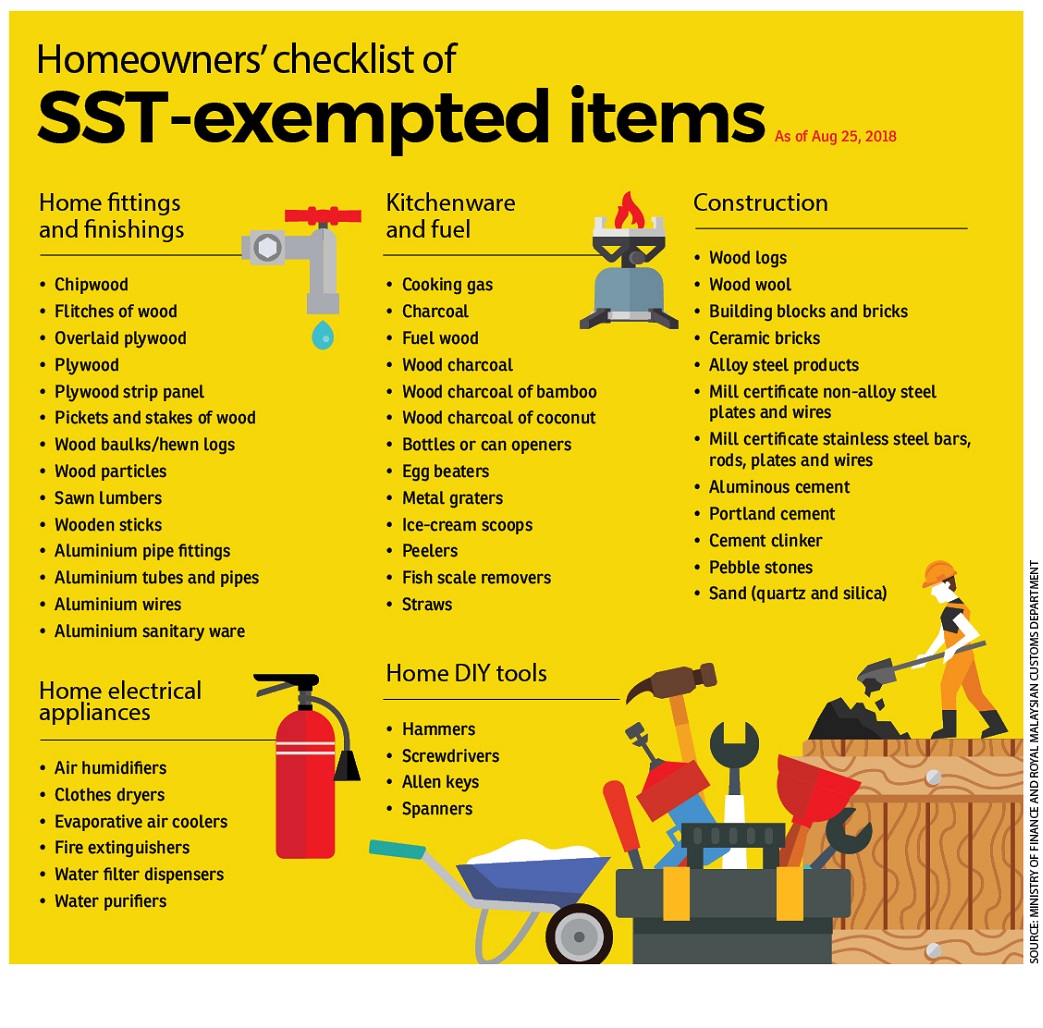

. The complete list can be found on the SST Orders page of the MySST website. Live animals fish seafood and certain essential food items including meat milk eggs vegetables fruits bread etc. However there are some goods exempted from Sales Tax such as.

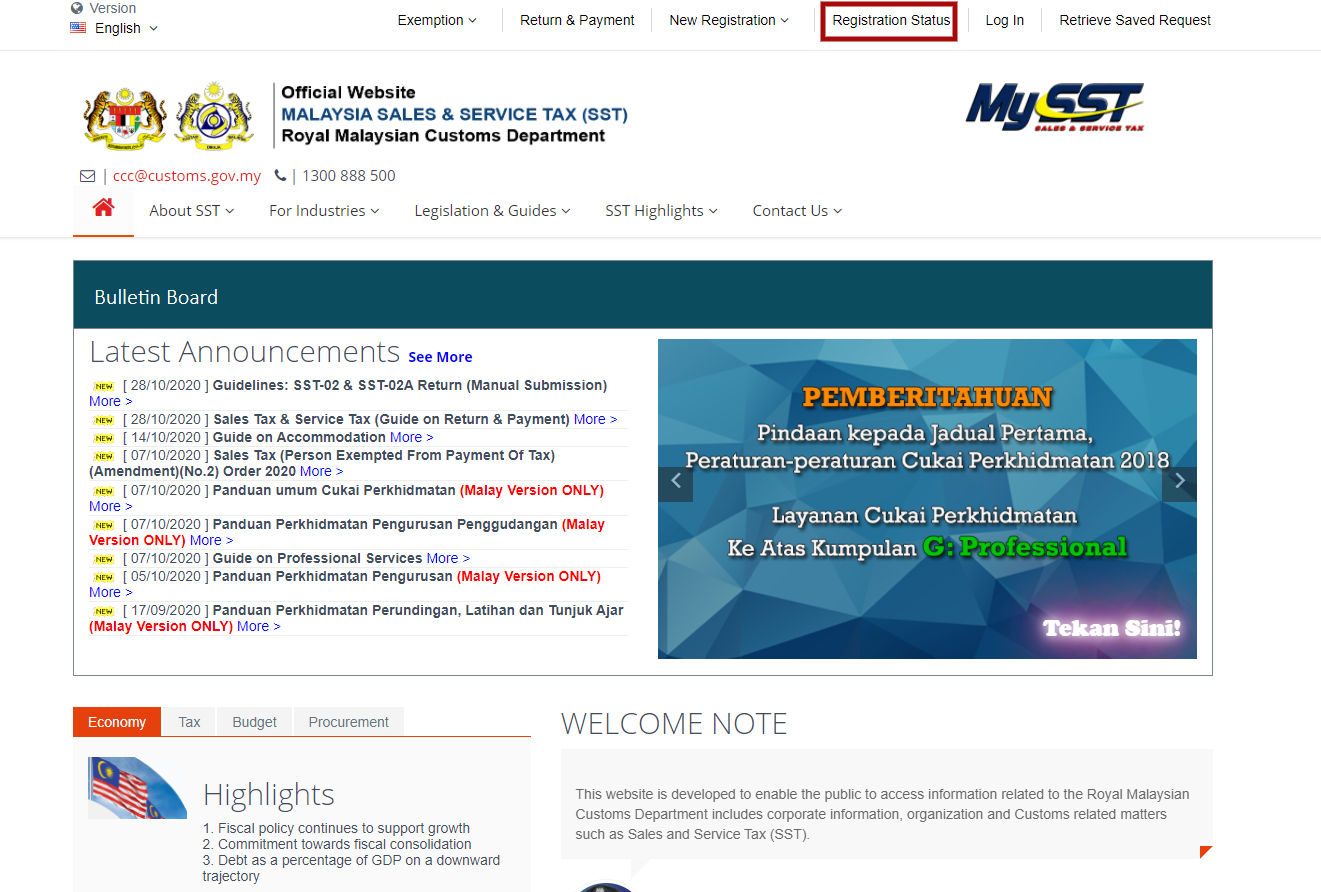

The designated areas in Malaysia such as Langkawi Island Tioman Island and Labuan are exempted from service-tax. Effective 1 September 2018 the Malaysian Government has replaced the Goods and Services Tax GST with Sales and Service Tax SST. User Manual schedule A - wakil yang dilantik item 45781213-orang yang dilantik oleh kerajaanPBTIPTA Click Here.

User Manual schedule A - sendiri lain-lain Click Here. If you leave the SST statement format mapping field blank the standard sales tax report will be generated in SQL Server Reporting Services SSRS format. The SST replaces the existing Goods and Services Tax GST and affects all domestic and import shipments.

Select the category hierarchy. Sales Tax 10. The customs department has proposed exemptions on a long list of consumer goods including poultry fish milk vegetables and.

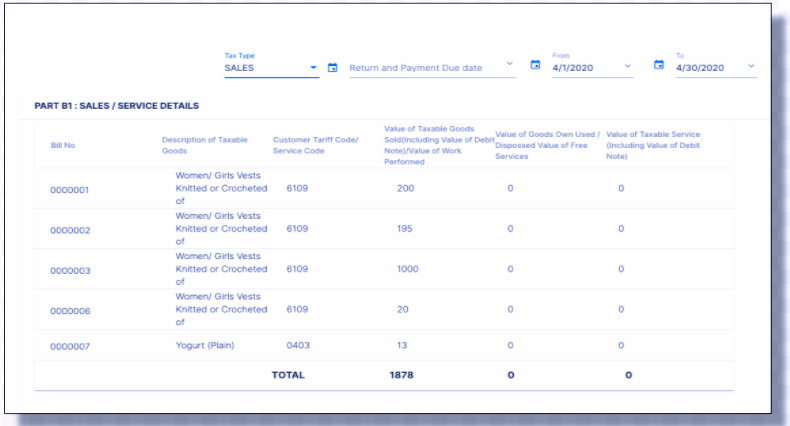

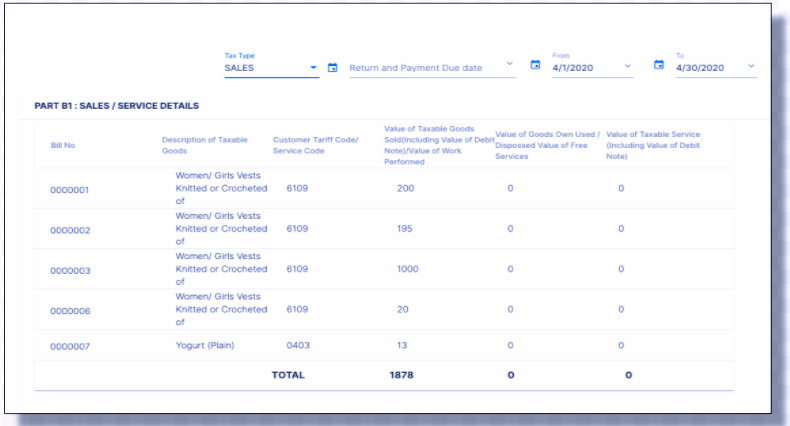

The sales tax a single stage sales tax is charged by the registered manufacturers of taxable goods and on any imported taxable goods to Malaysia. Sales Tax Act and Service Tax Act. Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline.

On the Sales tax tab in the Tax options section in the Electronic reporting field select SST-02 Declaration Excel MY. A new analytic view called supplier invoice list is added in order to check the. The SST has two elements.

User Manual schedule A - Melantik wakil item 45781213-kerajaanPBTIPTA Click Here. SST consist of 2 separate act. Copyright reserved malaysia.

The sales tax is based on exclusion criteria where all things are taxed by default unless being exempted whereas the service tax is. Books magazines newspapers journals periodicals etc. In this regard Bursa Malaysia Berhad and some of its subsidiaries have been registered for service tax purposes and will start charging 6 service tax on certain fees effective from 1 May 2019.

SST - List of Sales Tax Exempted and Taxable Goods Part 1 Sales and Service Tax SST has replaced the Goods and Sales Tax GST on 1st September 2018 in Malaysia. A service tax that is charged and levied on taxable services provided by any taxable person in Malaysia in the course and furtherance of business and a single stage sales. The Sales and Services Tax SST has been implemented in Malaysia.

More than 5500 items of imported goods are zero rated sst as well as.

Sales Service Tax Sst In Malaysia Acclime Malaysia

Welcome Back Sst So What S New Propsocial

Sst Will Property Prices Come Down Edgeprop My

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

2pcs Rc Upgraded Alum F R Shock Absorber For Sst 1937 Pro 1 10 Rc Car Parts 109003 In 2021 Rc Car Parts Brushless Rc Cars Rc Cars

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Malaysia Sst Sales And Service Tax A Complete Guide

No Sst For Essential Items The Star

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Sst Will Property Prices Come Down Edgeprop My

Adidas Sst Track Jacket Red Adidas Us Pantalones De Entrenamiento Equipo De Futbol Ropa Casual De Hombre

Malaysia Tax Filing Of Sst 02 Report Under Deskera Books

Goods And Person Exempted From Sales Tax Sst Malaysia

Malaysia Sst Sales And Service Tax A Complete Guide